Islamic finance has long been heralded as an alternative form of banking for those who wish to avoid the risks and interest that come with more traditional forms of banking in the West, and, of course, for Muslims who wish to respect Shariah law.

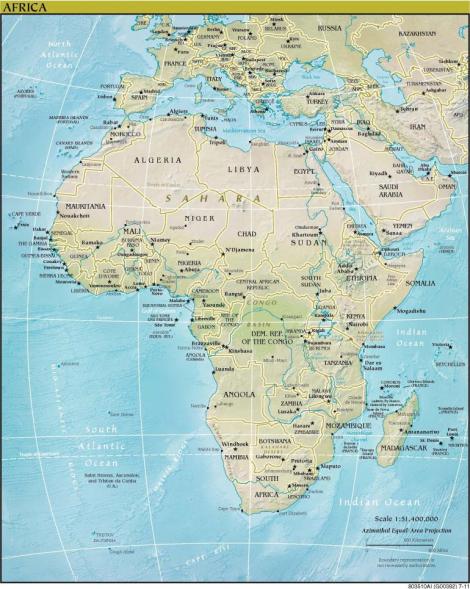

In Africa, especially, where more than 240 million people consider themselves Muslim, providing alternative financial products has become more of a priority. As International Business Times reported in September, the number of Africans born into the faith or converting to it is on pace to grow from 240 million to more than 400 million in the next two decades.

The projected dramatic rise in the continent’s Muslim population holds great opportunity for banks offering Shariah-compliant products. | Wikimedia

To respond to that increase, Islamic banks are springing up all over the continent, creating policy and regulatory issues for many countries that must now adopt different rules and laws to help facilitate the complexities of Shariah-related finance.

Among the newer products being used in Africa is a sakk, which is the singular form of an Arabic word for financial certificates but which often refers to Islamic bonds. Because fixed-income, interest-bearing bonds are not allowed in Islam, sukuk (the plural of sakk) are structured to work with the investment principles of Islamic law, which prohibit charging or paying interest.

Earlier this year, Nigeria’s Securities and Exchange Commission settled on new rules that would enable the issuance of sukuk. Increasing use of sukuk to finance infrastructure has made it easier for Muslims to use the financial systems in Africa, a continent that has primarily been a cash economy until very recently. Nigeria managed to raise about $62 million from international investors and domestic pension funds. Prior to Nigeria’s ruling, only Gambia and Sudan had issued local-currency short-term domestic notes.

Senegal plans a $200 million program in 2014 that will focus on energy products. The Islamic Corporation for the Development of the Private Sector has said that Senegal will be the first country to take part in a West African program to issue Islamic securities, and an additional eight member countries will use the Senegalese sukuk as part of a repurchase program after the 2014 rollout begins.

The success in Nigeria and the imminent launch of similar projects is good news for Africa because it all points to a self-sustaining, innovative environment that is funding development needs. It’s something the 600 Islamic institutions in 75 countries around the world will be looking at carefully for investment potential, as global Islamic financial assets are estimated to be worth about $1.3 trillion and they’re growing at a rate of about 20 percent.

*This article was published by International Business Times. Read the original article here.